Pilotbird Lifestyle Risk Scoring

Take to the new level the underwriting accuracy for group and

individual using lifestyle risk scoring.

Take to the new level the underwriting accuracy for group and

individual using lifestyle risk scoring.

Score for assessment

of lifestyle risk.

Hit rate for confidence level.

Designed for efficient use

by teams.

In first year

Elimination

of bad business

Pilotbird supports a global Fortune 500 carrier by analyzing its $400M+ book of basic group life product. Pilotbird Lifestyle Risk Scoring engine improves accuracy for the underwriting process and generates model lift > 3x over the existing model. The effort calibrates the score to the carrier’s actual loss experience.

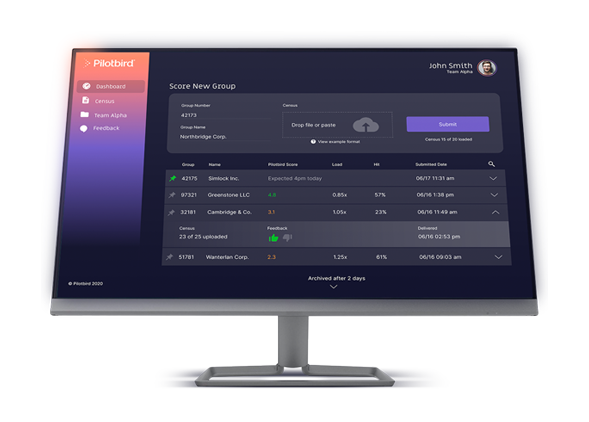

Pilotbird offers a Fortune 500 carrier a web-portal to access the Pilotbird Lifestyle Risk Scoring engine. The portal is designed to empower underwriting teams with easy integration into their existing workflow. Based on the carrier’s request, Pilotbird enhances the portal to accommodate audit and utilization features. Following a calibration phase, Pilotbird Lifestyle Risk Scoring is expected to eliminate ~5% of bad new business.